Forex Trading and Related Laws in India

Forex Trading and Related Laws in India: What You Must Know About RBI Guidelines

Forex trading—the buying and selling of foreign currencies—is one of the largest and most liquid markets globally. In India, however, forex trading operates under strict legal frameworks set by regulatory bodies like the Reserve Bank of India (RBI) and the Securities and Exchange Board of India (SEBI). If you’re planning to dive into forex trading from India, it is crucial to understand the legal landscape to ensure you stay.

What is Forex Trading?

Forex trading, or foreign exchange trading, involves exchanging one currency for another with the aim of making a profit. For example, buying US dollars (USD) by selling Indian rupees (INR) and later selling USD at a higher price. Globally, forex markets operate 24 hours a day, five days a week, offering massive trading volumes and opportunities.

However, unlike other countries, India treats forex trading differently, with strict regulations to protect retail investors and maintain currency stability.

Is Forex Trading Legal in India?

Yes, forex trading is legal in India only under specific conditions.

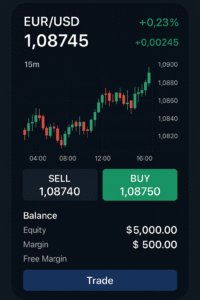

You are allowed to trade in currency pairs where the Indian Rupee (INR) is one of the currencies. Trading foreign currencies against each other (like USD/EUR, GBP/JPY) through online platforms or offshore brokers is illegal for Indian residents.

Forex trading must happen through authorized brokers registered under SEBI and adhere to RBI guidelines.

RBI Guidelines for Forex Trading

The Reserve Bank of India (RBI) regulates forex trading under two key frameworks:

-

Foreign Exchange Management Act (FEMA), 1999

-

Master Direction – Risk Management and Inter-Bank Dealings

Here are the essential RBI guidelines every Indian forex trader must know:

-

Permissible Currency Pairs:

You can trade only in INR-based pairs such as:-

USD/INR

-

EUR/INR

-

GBP/INR

-

JPY/INR

Recently, cross-currency derivatives like EUR/USD, GBP/USD, and USD/JPY have been allowed on Indian exchanges but only through recognized exchanges like NSE, BSE, and MSE.

-

-

Authorized Platforms:

Forex trading is permitted only through SEBI-registered brokers and authorized Indian exchanges like:-

NSE (National Stock Exchange)

-

BSE (Bombay Stock Exchange)

-

MSE (Metropolitan Stock Exchange)

Trading through apps or websites of foreign brokers without RBI approval is illegal.

-

-

Leveraged Trading:

Indian brokers offer limited leverage on forex trades, unlike the high leverage offered by foreign brokers. This is to protect retail traders from large, unexpected losses. -

Purpose Restrictions:

Retail forex trading is allowed primarily for hedging purposes and not purely for speculative gains. -

Reporting Requirements:

Any forex transaction must be reported and must comply with the limits set under the Liberalized Remittance Scheme (LRS) if applicable.

Permitted Currency Pairs for Trading in India

Here’s a simple table for clarity:

| INR-Based Pairs | Recently Permitted Cross Pairs (on Indian exchanges) |

|---|---|

| USD/INR | EUR/USD |

| EUR/INR | GBP/USD |

| GBP/INR | USD/JPY |

| JPY/INR | EUR/JPY |

You must ensure that your trades happen only through SEBI-regulated platforms.

What Happens If You Trade Forex Illegally?

If you trade with an unauthorized foreign broker or deal in unauthorized currency pairs, you risk:

-

Heavy penalties under FEMA regulations

-

Account freezes by Indian banks

-

Prosecution by the Enforcement Directorate (ED)

RBI periodically warns the public against unauthorized forex trading platforms. It’s essential to always check whether your broker is SEBI-registered and RBI-compliant.

Final Thoughts

Forex trading in India is legal but heavily regulated.

If you want to engage in forex trading safely and legally, always use Indian platforms, trade only in permitted currency pairs, and follow RBI and SEBI regulations strictly.

Understanding and complying with the RBI guidelines for forex trading not only ensures a safe trading experience but also protects you from unnecessary legal troubles.

Forex Trading and Related Laws in India, Forex Trading and Related Laws in India, Forex Trading and Related Laws in India

Frequently Asked Questions (FAQs)

Q. Can I trade forex through apps like OctaFX or XM from India?

No. Trading through foreign apps not regulated by SEBI is illegal for Indian residents.

Q. Is forex trading taxed in India?

Yes, forex trading profits are taxable under “Income from Other Sources” or “Business Income,” depending on your trading activity.

Q. What are some SEBI-regulated forex brokers?

Some reputed SEBI-regulated brokers offering forex services are Zerodha, ICICI Direct, HDFC Securities, and Upstox.

Previous Post

Previous Post Next Post

Next Post